Module 5: Accounting procedures (commonly done in practice)

Prepared by:

IDEC SA

Introduction

This module refers to commonly done in practice accounting procedures for start up women entrepreneurs. Specifically refers to the opening of bank accounts, their types, the methods of banking transactions and information about e-commerce and online (or through credit card) payment system. It also contains directions for their implementation.

1. Basic concepts and explanations

What is A Bank Account?

A bank account is a safe and useful place of your choice to deposit all your money. You can access your money from any ATM. It also makes it easier to save and invest your money for your future.

Types of Bank Accounts

Most banks and credit unions offer the following types of accounts:

- Savings accounts

- Checking accounts

- Money market accounts

- Certificates of deposit (CDs)

- Retirement accounts

What is a Checking Account? What is Mobile & Online Banking?

A checking account offers easy access to your money for your daily transactional needs and helps keep your cash secure. Customers can use a debit card or checks to make purchases or pay bills. Accounts may have different options or packages to help avoid certain monthly service fees. To determine the most economical choice, compare the benefits of different checking packages with the services you actually need.

Mobile banking allows you to perform many of the same activities as online banking using a smartphone or tablet instead of a desktop computer. Mobile banking’s versatility includes:

- Logging into a bank’s mobile website

- Using a mobile banking app

- Text message (SMS) banking

Online banking refers to any banking transaction that can be conducted over the internet, generally through a bank’s website under a private profile, and with a desktop or laptop computer. Online banking is generally defined as having the following characteristics:

- Financial transactions through bank’s secure website.

- Physical branch locations or only online.

- The user must create a login ID and password.

How to Open a business bank account for Your Start up?

A business bank account allows you to easily keep track of expenses, manage employee pay, convey finances to investors, receive and deposit payment, and plan your budget more accurately. Creating a business bank account requires simple steps to get you working quickly:

- Determine What Accounts You Need

- Choose your Bank

- Obtain Your Business Name

- Get Your Paperwork in OrderGet Ready to Accept Payments

The Difference Between Credit Card and a Debit Card

A credit card is a card that allows you to borrow money against a line of credit, otherwise known as the card’s credit limit. You use the card to make basic transactions, which are then reflected on your bill. Debit cards draw money directly from your checking account when you make the purchase. It can take a few days for this to happen, and the hold may drop off before the transaction goes through.

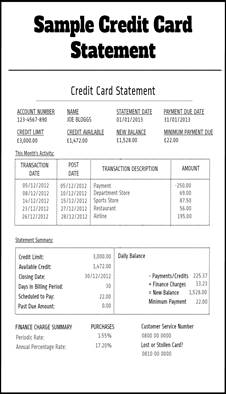

2. Things You Should Know Before You Get Your First Credit Card (e.g. what is a credit card statement, how credit card interest is calculated, how minimum payments are determined)

A billing statement is a periodic statement that lists all the purchases, payments and other debits and credits made to your credit card account within the billing cycle. Your credit card issuer sends your billing statement about once a month.

What's on the billing statement?

Your billing statement lists everything you need to know about your credit card account. It includes:

- Your balance from the previous billing cycle

- The minimum payment due

- The payment due date

- Late fee that will be charged if you pay late

- A summary and detailed list of payments, credits, purchases, balance transfers, cash advances, fees, interest, and other debits made to your account

- A breakdown of the types of balances on your account and the interest rate and interest charges for each

- Your credit limit and available credit

- The number of days in your billing period

- Total amount of interest and fees paid year-to-date

- Contact information for your credit card issuer

- Rewards earned or redeemed, if applicable

Your credit card statement will include a minimum payment disclosure detailing the amount of time it will take to pay off your balance if you only make the minimum payment and the total amount you'll end up paying. It will also include the monthly payment to make if you want to pay your balance off in three years. This information is helpful for figuring out the best way to pay off your credit card balance.

Your credit card billing statement will also include a late payment warning that tells you the impact of sending your payment late - a late payment and penalty rate increase.

Your credit card minimum payment is the least amount you can pay toward your credit card balance without being penalized with a late fee and possible interest rate increase. If you pay attention to your billing statement each month, you've probably noticed that your minimum payment can change from one month to the next.

Some credit card issuers calculate the minimum payment as a percent of the balance, typically between 2% and 5%, at the end of the billing cycle.

Your minimum payment may be also calculated by taking a percent of the balance at the end of the billing cycle and adding the monthly finance charge.

You can find out which method your credit card issuer uses by reading your credit card agreement. Look for a section titled "How your minimum payment is calculated" or "Making payments."

3. E-commerce payment system

An e-commerce payment system is a way of making transactions or paying for goods and services through an electronic medium, without the use of checks or cash.

What is to set up Automatic Payments?

An automatic bill payment is a money transfer scheduled on a predetermined date to pay a recurring bill. Automatic bill payments are routine payments made from a banking, brokerage or mutual fund account to vendors. They are usually set up with the company receiving the payment, though it’s also possible to schedule automatic payments through a checking account’s online bill pay service.

Accepting online payment with a credit card, debit card, or PayPal

Enabling your customers to pay with their credit card on your website is the most basic way you can accept online payments. To offer this feature to your customers, you’ll want to decide whether to have your own dedicated merchant account or use an intermediary holding account.

Small businesses or organizations that want to accept online credit card payments for services, subscriptions, or products sold on a website may add PayPal buttons to any website.

Secure online payment system requires

Online security is something that concerns us all as consumers. As a business owner, it’s even more important. By taking online payments, you take responsibility for protecting your customers’ data, and managing it securely can be a costly burden. But you can make it easy on yourself by using a PCI-compliant payment solution. PCI compliance refers to the rules and regulations that govern data protection.

Online payment solutions with card, invoice and bank

Online payments are made instantly, so it’s convenient and saves lots of time.

The so called "online wallets" allow their customers to:

- Pay online with revealing their credit card details,

- Pay an invoice.

- Pay to a bank account.

What is Virtual Point of Sale (POS)?

Virtual POS Terminal. It is a payment gateway which allows online merchants and service sellers to manually authorize card transactions initiated by the buyer. This process expands greatly their payment sources and reduces the time of the payment process, while adding additional security. The integration of virtual POS terminal is possible with numerous e-commerce platforms.

3. E-commerce payment system

3.1. What is brand name?

Follow the directions below to open a bank account

Consider your options

Once you’ve identified your needs, evaluate your options:

- Checking account

- Savings account

You may have chosen which bank account best suits you but, you will also have to make sure you're eligible to open an account. Before you head to the bank, you will need to check whether you meet all the criteria for opening an account.

As a general rule, banks will require the following:

Valid Identification. In some countries you may also need your Social Security number.

A minimum amount of money for opening the account. This can vary based on the bank and account you choose. For example, a savings account of an average bank requires a minimum deposit of 300€.

Choose the bank that's best for you. Contact the bank branch in your local area to discuss what exactly you'd get if you opened a basic account. While all banks are different, they can generally be summed up into two general categories: large chain banks and smaller local ones.

Large chain banks: Large banks usually have branches in most towns and cities across the country. You can avoid fees you'll have to pay for using other banks' services (like ATM fees, etc.) Large banks also offer services like 24-hour help lines for their customers. In addition, these banks tend to have a stable, trusted reputation.

Smaller local banks: Small banks offer a more personal, friendlier and human experience. Smaller banks also usually charge smaller fees for using their services. Smaller banks often invest their money into the local community. On the other hand, smaller banks fail more frequently than large banks (this is still very rare, though).

In addition, credit unions are another option for banking. Credit unions are not-for-profit financial institutions, often with a mission to be "community-oriented" and "serve people, not profit. Credit unions have successfully made their services more accessible by partnering with other credit unions to offer shared branch banking and ATMs.

Visit your bank and ask to open an account. Opening an account in person is usually the best option for first-time account holders. You can ask the teller all the questions and doubts you have and get immediate answers. Also, the process of opening an account is also usually speedier in person.

Ask all the important questions before you finalize your account. Ask for clarification on any issues regarding your account.

Supply the necessary information to create your account. Opening a checking account requires a few basic pieces of personal information. In general, it's a good idea to have:

Proof that you are who you say you are: Have a government-issued ID with your photo on it with you (a driver's license or a passport may also be enough).

Proof of address: A phone bill, driver's license, or any other official document with your name and address will usually do.

Proof you are a registered citizen: The bank will ask for your Social Security number, taxpayer identification number, or employer identification number to ensure that you are "on record" with the government

Keep the account documents you receive secure. When you finish completing your account, you will receive documents that contain important information about your account. Keep these in a safe place. If you can, it's a wise idea to commit the following information to memory so that you don't need to rely on the documents in the future:

Your four-digit PIN number: You need this to use your debit card for purchases.

Your bank account number: You need this for financial tasks like setting up direct deposits

Your Social Security number: You need this for various tax and financial tasks in the future

3. E-commerce payment system

3.2. Starting Mobile & Online Banking

Follow the directions below to start Mobile & Online Banking

What you’ll need

- A valid debit or credit card

What you do

On your mobile device:

Download and open the Mobile Banking App on your Android or Apple device. Follow the steps below.

From a computer:

Step 1: Visit the bank’s homepage

Step 2: Select “Register”

Step 3: Enter your card number and expiry date and select “Continue”

Step 4: Say how you want to receive your verification code

There are some banks that provide, also, the following service:

Step 1: When you complete sensitive transactions, a verification code protects you with an extra layer of security. They may send you a 6-digit verification code by text message, email or voice call. You’ll enter that code to complete the transaction.

Step 2: There are some that may send one-time verification codes to personal or free email services.

Step 3: Enter the verification code in the Identity Verification box and select “Continue”

Step 4: Choose a password

Step 5: Review the fine print

Step 6: You’re almost done! Read the Electronic Access Agreement and check the box to confirm you’ve read it.

Step 7: Sign on and start banking

Step 8: Now that you’ve registered, you can bank from any computer, smartphone or tablet.

Step 9: If your device supports fingerprint sign-on, there are some Bank’s applications that you can use the fingerprint reader to verify your identity and access your accounts in a tap.,

3. E-commerce payment system

3.3. Receiving payments

Follow the directions below to setting up your business to receive payments

STEP 1: Set Up Your Business

Check the options in advance, in order to set up the right organization and structure. That way you won’t end up with the wrong type of business. In many cases, you can change it later, but it helps to research ahead of time to see what might work best for you, whether that’s a sole proprietor, an LLC, S-Corp, C-Corp, or some other type of organization. An accountant can help you set up your business and take care of the necessary paperwork.

If you have partners, make sure all of their information is accurate as well.

STEP 2: Get an Identification Number for your business

Getting an Identification Number is an essential first step because you will need this important number if you expect to open a business bank account.

You may need more than one identification numbers for your company (e.g. your VAT number when registering to the tax authority, your identification number when registering to the local Chamber, etc.).

Your company’s Identification Number can also be helpful if you want to receive payments through a processor like PayPal. It has also to appear on all receipts and invoices you issue.

STEP 3: Open a Business Bank Account

As you begin to receive payments, you need a place to put them.

Having separate accounts is important as a business owner. First of all, it’s a good idea to keep your business assets separate from your personal assets. Second, it makes record-keeping much easier. When tax time comes around, it’s much easier to take care of everything if it’s all in one place.

If you mix up your money with that of your company, you may end up having serious problems. You have always to have in mind that the time you receive money from your customers does not coincide with the time you have to pay for instance your rent, your taxes, your suppliers etc. Failing to understand the importance of making this distinction may result in shortage of money when actual payments occur, because the money has been spent to personal expenses.

Your business bank account is where you should have your income deposited and in general where you should undertake all transactions of your company.

STEP 4: Set Up to Receive Payments through a Third-Party

It’s important to accept a lot of different payment methods. Your customers and clients have their own payment preferences. One of the best ways to make sure you are accommodating them is to use a third-party processor.

You can establish a merchant account with a card processor or receive payments through a site like PayPal. When you use this type of processor, credit cards are usually taken care of.

It’s also possible to use processors to accept physical credit cards from your mobile device. This can be helpful if you have physical items to sell, and you do so in person.

STEP 5: State Business Requirements

Before you set up to receive payments, make sure you know the requirements for businesses in your state. Your country’s Ministry of Economy (or another competent authority) should have information on what you need to do in order to set up your business and begin doing business.

3. E-commerce payment system

3.4. First order form

Follow the directions below to set up your first order form

How to Create a Simple Order Form with Online Payments

In order to receive orders: you are going to get an idea on how to create a WordPress order form that will accept credit card and PayPal payments.

Step 1: Create a Simple Order Form in WordPress

Install and activate the WPForms plugin.

- Go to WPForms » Add New to create a new form.

- Name your form and select the Billing/Order form template.

- Scroll down to the “Available Items” section in the preview screen on the right and click on it.

- This will open up the “Field Options” in the left panel. Here you can rename the field, add or remove order items, and change the prices.

- If you want to give people images to choose from when filling out your order form, click on the Use image choices checkbox in the Form Editor.

- Lastly, you can add additional fields to your order form by dragging them from the left-hand side to the right-hand side.

- Click Save when you’re done.

Step 2: Configure Your Order Form Notifications

- Notifications are a great way to send an email when your form is submitted.

- You can send an email notification to yourself, to a member of your team by adding their email to the Send to Email Address field or to a customer to let them know their order has been received.

- Click on the Settings tab in the Form Builder and then click Notifications.

- Click Show Smart Tags in the Send to Email Address field.

- Click on Email

- Change your notification’s email subject to be more specific. In addition, you can customize the “From Name”, “From Email”, and “Reply-To” emails.

- Include a personalized message if the email is going to anyone but yourself.

- Use the {all fields} smart tag, if you want to include all the information found in the form fields of the submitted order form.

Step 3: Configure Your Order Form Confirmations

Form confirmations are messages that display for customers once they submit an order form.

There are three confirmation types you can choose from:

- Message. When a customer submits an order form, a simple message confirmation will appear letting them know their form was processed.

- Show Page. This confirmation type will take customers to a specific web page on your site thanking them for their order.

- Go to URL (Redirect). This option is used when you want to send customers to a different website.

Let’s see how to set up a simple form confirmation in WPForms so you can customize the message users will see after submitting their orders.

- Click on the Confirmation tab in the Form Editor under Settings.

- Select the type of confirmation type you’d like to create.

- Customize the confirmation message to your liking and click Save when you’re done.

Step 4: Configure the Payment Settings

WPForms integrates with PayPal for accepting payments.

To configure the payments settings on your order form, you’ll first have to install and activate the right payment addon.

Once you’ve done that:

- Click the Payments tab in the Form Editor.

- Click PayPal,

- Enter your PayPal email address,

- Select the Production mode,

- Choose Products and Services,

- Configure the payment settings,

- Click Save to store your changes.

Now you’re ready to add your simple order form on your site.

Step 5: Add Your Simple Order Form to Your Site

- Create a new post or page in WordPress and then click on the Add Form button.

- Select your simple order form from the dropdown menu and click Add Form.

- Publish your post or page so your order form will appear on your website.

- Go to Appearance » Widgets and add a WPForms widget to your sidebar.

- Select the Billing / Order Form from the drop-down menu.

- Click Save.

Now you can view your published order form live on your site. Notice when you select items on your form the price changes automatically.

You now know how to create a simple order form in WordPress that accepts online payments.

If you want to send orders as a business, you may use Google Docs’ order form.

Google Docs allows you to create forms that can be used as an order form. After the data is saved to your spreadsheet in Google Docs, you can handle the billing or ordering from there.

- Open Google Docs and click the "Create" button. Select "Form."

- Fill in the name and description of your order form.

- Break your form up into sections, if relevant.

- Add questions by clicking "Add Item.".

- Choose a theme for your form by clicking the "Theme" button beside the "Add Item" button.

- Click the link at the bottom of the form window to view your form in the browser.

- Distribute your form.

3. E-commerce payment system

3.5. Accepting payments with Bank Accounts

Follow the directions below to accept payments with Bank Accounts

A bank transfer is effected as follows:

- The entity wishing to do a transfer approaches a bank and gives the bank the order to transfer a certain amount of money. IBAN and BIC codes are given as well so the bank knows where the money needs to be sent.

- The sending bank transmits a message, via a secure system, to the receiving bank, requesting that it effect payment according to the instructions given.

- The message also includes settlement instructions. The actual transfer is not instantaneous: funds may take several hours or even days to move from the sender's account to the receiver's account.

- Either the banks involved must hold a reciprocal account with each other, or the payment must be sent to a bank with such an account, a correspondent bank, for further benefit to the ultimate recipient.

Before you can receive an international payment, you'll need to provide the sender with some details, including:

- Your International Bank Account Number (IBAN)

- Your sort code

- Account number

- Your full name

- Your address

- The amount and the currency you’d like to receive the payment in.

3. E-commerce payment system

3.6. PayPal Business Account

Follow the directions below to setting Up a PayPal Business Account

Follow the guides below to complete your account set-up. You’ll need to confirm your email address, verify your PayPal account and choose a PayPal payment solution.

STEP 1: PayPal sent you an email when you signed up for your PayPal business account. Click the link in the email to confirm your email address. If you can’t find the email, log in to your PayPal account and click Confirm email address in your “To-do list” under the Business Profile icon.

STEP 2: By getting verified, you'll not only gain more credibility with your sellers and buyers, but also remove the withdrawal limit on your account. There are 2 ways to get verified:

- Confirm your UnionPay card (instant verification)

Add or review your UnionPay card details. Proceed to confirm the card by authorizing China UnionPay to send a verification code via SMS. Enter the code to confirm your card instantly.

- Confirm your credit card

Add or review your Visa or MasterCard to your PayPal account and proceed to confirm the card. This generates a 4-digit code, which will be reflected in your credit card statement within 2-3 business days. Log in to your PayPal account, enter the code to complete the verification process.

STEP 3: Choose a payment solution to suit your business.

3. E-commerce payment system

3.7. Accepting payments by Credit Card

Follow the directions below to accept payments by Credit Card

For accepting payments by Credit Card, you will need:

- Merchant Account: A type of bank account where credit and debit card payments get deposited

- Virtual Terminal: Like a digital credit card swipe machine, this system allows you to input credit card information on your computer.

- Gateway: The connector between your online store and the bank, which sends payment information securely to be approved or declined.

How It Works Step-by-Step

Step 1. When a client contacts you, he/she logs in to your virtual terminal and select the products or services he/she wishes to buy. He/she then has to enter his/her credit card information.

Step 2. The payment information passes through the secure payment gateway and is transmitted to the authorization source.

Step 3. The bank that issued the credit card receives the transaction information, checks if the funds are available, and approves or declines the release of payment.

Step 4. The payment gateway “tells” you if the payment was accepted or declined.

Step 5. If approved, funds are deposited into your bank account in 2-3 days.

3. E-commerce payment system

3.8. Point of sale credit card processing

1. First, choose the right point of sale system for your business.

There are many considerations in choosing a point of sale (POS) system. First, you’ll want to think about how you would like to accept payments. Will you do most of your business instore or online or a combination of both? Do you want to be able to take payments offsite? What is your budget for purchasing POS hardware, software and peripherals like barcode scanners and receipt printers? What are your plans for expanding your business in the future?

The answers to all these questions will help lead you to the system that’s right for your business.

2. Choose a compatible payment processor or payment gateway

You also need to decide which payment processor or payment gateway to work with. A payment gateway is a third party hosted payment solution that allows you to connect with your chosen payment processor as long as the gateway works with that processor.

3. Make sure your solution includes the necessary security features to keep transactions safe and protect your customers and your business from a breach.

A data security breach is not only bad for business, it can be devastating. So, it’s in your best interest to do everything you can to prevent a breach from happening in the first place.

Payment security demands a multi-pronged approach encompassing both technology solutions and best practices. It’s best accomplished in partnership with a payment processing provider.

4. Prioritize the value-added features you want in your payment solution.

Your business is unique and as such, will have unique needs when it comes to processing payments.

In order to get the most out of your POS solution, it’s worth thinking about the features you want, and evaluating the availability and costs offered by various providers.

5. Don’t forget to ask about installation assistance and staff training.

The best payment solution in the world offers little value to your business if it’s too difficult to install or to learn how to use it. Ask for a product demo so you can try out the solution in real-time. Be sure to ask about set-up and integration to your existing systems. Find out about fraud protocols and whether necessary updates are automatically executed or if you have to implement them yourself. And of course, there’s the basics of processing. Find out how you will run various payment types.

5. References

www.nerdwallet.com/blog/11-credit-card/

https://www.wikihow.com/Open-a-Bank-Account

https://en.wikipedia.org/wiki/Mobile_banking

https://due.com/blog/set-up-your-business-to-receive-payments/

https://wpforms.com/how-to-create-a-simple-order-form-in-wordpress/

http://www.banking.org.za/consumer-information/conventional-banking/what-is-a-bank-account

https://www.thebalance.com/types-of-bank-accounts-315458

https://www.inc.com/aj-agrawal/how-to-open-a-business-bank-account-for-your-startup.html

https://www.thebalance.com/difference-between-a-credit-card-and-a-debit-card-2385972

https://www.thebalance.com/credit-card-billing-statement-959999

https://www.discover.com/credit-cards/resources/how-does-my-credit-card-interest-work

https://www.thebalance.com/credit-card-minimum-payment-calculation-960238

https://securionpay.com/blog/e-payment-system/

https://www.investopedia.com/terms/a/automatic-bill-payment.asp

https://blog.mypos.eu/virtual-pos-terminal/

https://paysimple.com/blog/all-the-ways-you-can-accept-online-payments-in-2018/

https://fitsmallbusiness.com/accept-credit-cards-online/

http://www.transact.money/2007/10/definition-of-online-payment-systems.html

https://www.paypal.com/c2/webapps/mpp/paypal-get-started?locale.x=en_C2

http://www.billbaren.com/creditcardguide/

https://www.vantiv.com/vantage-point/smarter-payments/processing-through-point-of-sale