Module 4: Registration Procedures

Prepared by:

AFIKAD

Introduction

1. Basic concepts and explanations

1.1. What is brand?

A brand is a name, logo, sign or shape which singularly, or in combination, allow the consumer to differentiate the product or service from others in the marketplace (Shim 2009).

1. Basic concepts and explanations

1.2. What is brand name?

A brand name is either a word or numbers in some combination which can be verbally expressed (Shim 2009).

As an example; 3M, Google, XEROX, etc.

1. Basic concepts and explanations

1.2. What is brand name?

1.2.1. What is the difference between a brand name & a trade mark?

A business/ trade/ company name is; a name or a way to help identify a business, an entity or an individual. It is the official name under which the said entity or individual chooses to do business (Cameron 2017).

A trademark is; a word, phrase, logo, symbol, design, colour or a combination of one or more of these elements that distinguishes one company’s products/services from that of another (Cameron 2017, Shravani 2017).

Differences between a brand name and a trade mark are as below (Anonymous 2018a, Shravani 2017):

- Brand names and trademarks are valuable assets to a business. Often a brand or trademark becomes synonymous with the product. It is a mistake to use the terms "trademark" and "brand" interchangeably, as they have very important differences.

- While brand represents reputation and business in the public eye, a trademark legally protects those aspects of the brand that are unique and specific to the company.

- A trademark is legal protection of the brand, granted by the Trademark and Patent Office.

- All trademarks are brands, while not all brands are trademarks.

As an example: Coco Chanel is a perfect example of a name that is a trademark. The famous designer Coco Chanel built her successful fashion empire by using her name. People knew that if they were to purchase a Coco Chanel product they were going to receive quality craftsmanship. Through her reputation of having excellent taste, her name became recognizable around the world. Coco Chanel, her name is considered a trademark, surname Chanel is considered as a brand (Husbey 2016).

1. Basic concepts and explanations

1.2. What is brand name?

1.2.2. What is the difference between a business name, a trading name and a legal name?

A business name is; the official name of the person or entity that owns the company.

It is business’s legal name. A business name is used on government forms and applications (Cameron 2017).

As an example : Enterpreuner’s name is John Smith, and he owns an insurance business. Companies’ legal name can be John Smith Insurance (Anonymous 2018b).

Business owners can use a trade name for advertising and sales purposes. The trade name is the name the public sees, like on signs and the internet (Cameron 2017).

Business name and trading name can be different. A trade name does not need to include LLC, Corp, or other legal endings used for tax entity (Cameron 2017).

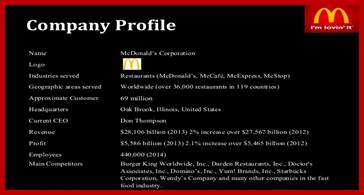

As an example: McDonald’s is a trade name. The company’s legal business name is McDonald’s Corporation (Anonymous 2018c).

A legal name of a business is; the name of the person or entity that owns a business. If the business is a partnership, the legal name is the name given in the partnership agreement or the last names of the partners.

For limited liability companies (LLCs) and corporations, the business' legal name is the one that was registered with the state government. These names will often have a “legal ending” such as LLC, Inc. or LLP (Fishman 2015).

When should a legal name or trade name be used?

A legal name should be used when communicating with the government or other businesses.

For example, the business’ legal name should be used when filing tax returns, buying property, or writing checks.

A company may use a trade name for advertising and trade purposes. It is often the name the general public sees on signs, the internet, and advertisements (Anonymous 2018d).

Basically,

Legal name is for government procedures,

Trade name is for public relations.

1. Basic concepts and explanations

1.2. What is brand name?

1.2.3. What is the difference between a business name, a trading name and a legal name?

The development and launch of a new brand requires the investment of a great deal of financial, mental and emotional capital and it is for this reason that brand registration, or legal protection of the new brand, should be a top priority for any new business venture. This applies whether the new brand is a new company, new product or service, or new online business (Anonymous 2018e).

Brand registration is another name for trademark registration and this is the only way that a brand owner can get exclusive rights to use the new brand in any given national territory. Neither limited company incorporation nor domain name registration will provide any legal protection for a new brand (Forbes Agency Council 2017).

Without a trademark registration, there is no way to prevent competitors or “copycats” from using the same brand.

1. Basic concepts and explanations

1.2. What is brand name?

1.2.4. How to register a trademark for a company name?

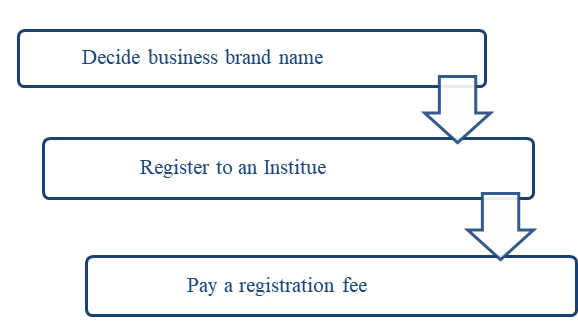

Every country has their own bureau or office for registering trademarked name or logo. Also, every country have different procedures according to countries’ laws and regulations. To register a trademark, company or a related person has to pay a registration fee.

The term of trademark registration can vary, but is usually ten years. It can be renewed indefinitely on payment of additional fees. Trademark rights are private rights and protection is enforced through court orders.

1. Basic concepts and explanations

1.3. What is brand name?

For TÜRKİYE

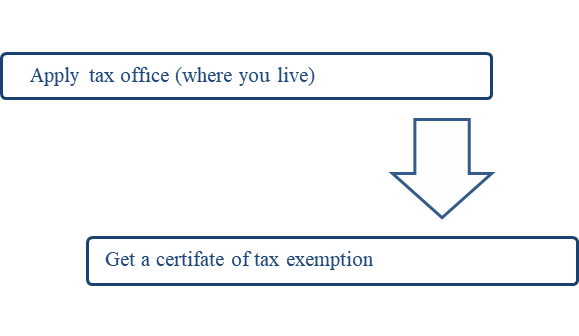

If women want to exempt from tax, needed to oblation ‘Craft Certificate of Exemption’ (Esnaf Vergi Muafiyet Belgesi)

If women want to be taxpayer for the future growing plan, e-Declaration-System is valid. They can apply this system in electronic platform (online). The records of the documents received and given by the taxpayers are kept in the chambers of the profession to which the taxpayers belong (National Report Turkey, 2018).

‘Craft Certificate of Exemption’ (Esnaf Vergi Muafiyet Belgesi) (National Report Turkey, 2018);

- After getting that certificate, registration should be done to a trade association affiliated to the Confederation of Turkish Tradesmen and Craftsmen.

- For work permission, application to the municipality with a petition should be done.

- For home business, all apartment owners must have an agreement with notary channel.

- Invoice and declaration are obligatory.

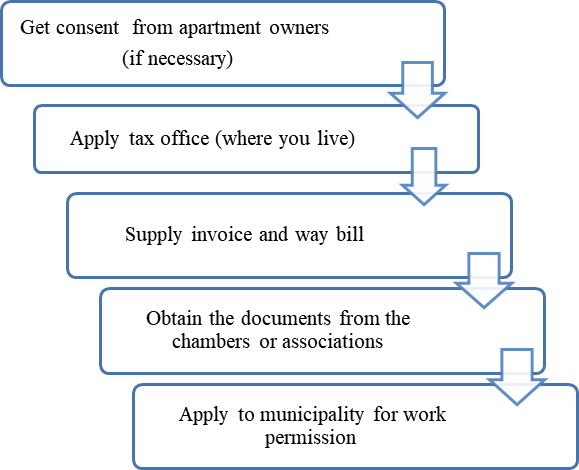

Tax-payers (National Report Turkey, 2018):

- Apply e-Decleration System.

- After approval of tax-payer, should be registered to a association affiliated to the Confederation of Turkish Tradesmen and Craftsmen.

- Apply to the municipality with a petition for work permission.

- The taxpayers will obtain the documents from the chambers or associations.

- Invoice and way bill are obligatory.

For SLOVENIA

To establish a firm, filling of register application CEIDG-1 is required. With this form:

- Getting VAT number is necessary,

- Statement on the selection of the form of taxation with income tax on individuals,

- Notification of declaration of contribution to social security (National Report Slovenia, 2018).

There are 3 areas that require licenses:

- Real estate and brokerage and property management,

- Performing road transport services,

- Running a work agency, a temporary work agency, an unemployment training institution training for public funds (National Report Slovenia, 2018).

For POLAND

To establish a firm, filling of register application CEIDG-1 is required. With this form:

- Getting VAT number is necessary,

- Statement on the selection of the form of taxation with income tax on individuals,

- Notification of declaration of contribution to social security (National Report Poland, 2018).

There are 3 areas that require licenses:

- Real estate and brokerage and property management,

- Performing road transport services,

Running a work agency, a temporary work agency, an unemployment training institution training for public funds (National Report Poland, 2018).

For GREECE

|

Steps |

Description |

|

1 |

Get approval of the company's name from Chamber of Commerce and Industry |

|

2 |

File company documents with Athens Bar Association |

|

3 |

Sign Articles of Incorporation before a notary public |

|

4 |

Deposit capital in a bank |

|

5 |

Pay capital tax to the Tax Authority |

|

6 |

Get a stamp from the Lawyers' Pension Fund |

|

7 |

Get certification by the Lawyer's Welfare Fund |

|

8 |

Submit Articles of Incorporation and register with Court secretariat to get a register number |

|

9 |

Submit Articles of Incorporation summary for publication İn Official Gazette (FEK) |

|

10 |

Register at the Chamber of Commerce and Industry |

|

11 |

Register with Self-employed Insurance Organisation (OAEE) |

|

Agricultural Insurance Organisation (OGA), etc.. |

|

|

12 |

Get a tax number (AFM) for the business |

|

13 |

Commission e vendor to make stamp/seal |

|

14 |

Have the Tax Authority punch company receipt books and accounting log |

|

15 |

Notify Manpower (OAED) within 8 days of hiring a worker |

All new business owners will be required to complete the previous steps.

Self-employed must complete steps 4 and 10-15.

It is not necessary to obtain a specific license or permit to open an online shop for selling crafts (National Report Greece, 2018).

For FRANCE

Use INPI when the entrepreneur starts a business (National Report France, 2018).

What is INPI?

(National Institute of Industrial Property)is a public body under the supervision of the Ministry of Economy, Finance and Foreign Trade of Ministry of Productive Recovery and Minister Delegate for Small and Medium Enterprises, Innovation and Economy (National Report France, 2018).

Once the name is filled with INPI, the company has a term of 10 years.

Legal structure depends on;

- Self-enterprise,

- Sole proprietorship,

- Company.

In general for establishing a business, steps to follow as below (National Report France, 2018);

- Apply with requested documents to the CFE (Chamber of Commerce),

- APE code is given based on the main activity (code depends on main activity),

- Tax formalities,

- Social formalities, is carried out by CFE,

- Open a file at the Post Office,

- Open a bank account.

1. Basic concepts and explanations

1.4. What is tax identification number?

A Taxpayer Identification Number (TIN) is an identifying number used for tax purposes in the country (Anonymous 2018f).

All legal entities, unincorporated entities and individuals must obtain a tax identification number.

For TÜRKİYE

There is e-Declaration system is valid. Actually, now people’s ID number is used as Tax ID Number (TIN). ID must be notarized or approved by tax office officers. So, they can get the Tax ID Number (National Report Turkey, 2018).

- TIN in order to undertake professional or business activities in Türkiye.

- As of 1 July 2006, the National Identity Number is used as the unique identification number for Turkish citizens and all TINs for citizens were matched with their National Identification Number in tax database system.

For SLOVENIA

Upon entry of the required data into the tax register.

Additional alpha or numeric characters to the tax number can be required.

If an individual registers in the tax register as a personal entrepreneur, the financial administration doesn’t assign a new TIN (National Report Slovenia, 2018).

For POLAND

Each adult has to have tax identification number to account for the tax office.

If an adult becomes an individual entrepreneur, he/she has the same tax identification number to use (National Report Poland, 2018).

For GREECE

Each adult must have a tax ID Number.

In the case when an adult wants to be an individual entrepreneur, he/she must register the business to the tax authority.

With this authorization, he/she can use personal Tax ID Number in business purposes (National Report Greece, 2018).

For FRANCE

The French tax authorities issue a tax identification number to all natural people who have the obligation to declare taxes in France.

The TIN is assigned when the person registers in the tax authorities' databases.

It is assigned to all people created in the registration system of the Directorate-General of Public Finances (DGFiP) (referential PERS) for all taxes. It is a unique, non-significant, reliable and permanent identification number.

This tax number is indicated on the pre-printed income tax declaration form and on income tax and property tax notices.

The TIN that must be obtained by the account or contract holder, or the holder of the asset or the beneficiary of the income (National Report France, 2018).

1. Basic concepts and explanations

1.5. Tax basics

Tax liability is the amount of money an individual owe to tax authorities (Cameron 2017).

The government uses tax payments to fund social programs and administrative roles.

Basically, a tax liability is usually a certain percentage of one's income and varies according to income.

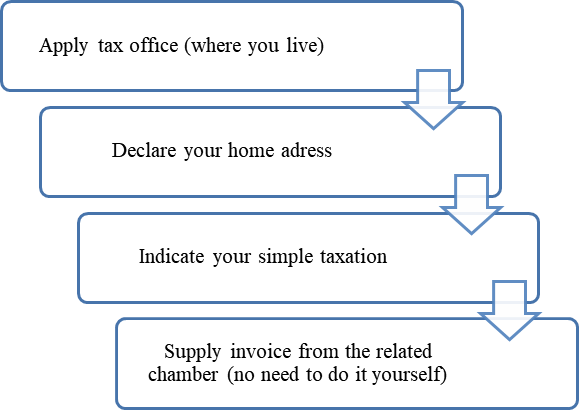

For TÜRKİYE

- It is necessary to make an address declaration. A home address can be an invoice address.

- During the application, simple taxation should be decelerated.

- After the evaluation of tax office, office will send tax card to tax payer.

- Registration should be done to ‘Confederation of Turkish Tradesmen and Craftsmen.

- Application should be done to municipality with a petition for work permission.

- The taxpayers who are subject to the small business taxation will obtain the documents from the chambers or associations.

- The taxpayers must declare their income by annual declaration.

- The declaration will be done to the registered tax office. As a result, the taxpayer will pay the tax based on the invoice (National Report Turkey, 2018).

For SLOVENIA

- VAT (value added tax)

- Corporate Income Tax

- Personal Income Tax

- Social Security Contributions

- Immovable Property Transfer Tax

- Capital Gains Tax

Choose business form;

- Personal entrepreneurs, taxations is an income from an activity, which is derived from the performance any entreprenurial agricultural, forestry, occupational or other independent self-employed activity.

- Limited liability company, is a legal personality and taxed with Corporate Income Tax.

- E-Sellers taxes, who is taxable person, is identified for VAT purposes, has to calculate VAT from the delivery of the product to the customer in Slovania (National Report Slovenia, 2018).

For POLAND

For individuals who want to conduct their own business, tax liabilities are paid on the basis of a tax on income, as is the case for full time employees. An individual must choose one:

- General rules tax,

- 19% tax (flat tax),

- Lump-sum from registered income,

- Tax card (National Report Poland, 2018).

For GREECE

- Individuals and businesses must submit an electronic tax declaration through online system of the Independent

- Authority of Public Revenue, based on which they will be taxed.

- At the end of each month, they submit the list of invoices and VAT.

- For individuals who want to conduct their own business, tax liabilities are paid on the basis of a tax on income.

- As is the case for full-time emplooyes- without the tax deduction is occurred.

- Irrespective of profits all Greek entities are taxed with rate of 29%.

- Shares are taxed with a rate of 15% (National Report Greece, 2018).

For FRANCE

Taxation of profits depends on the legal structure of the business. Entities may subject to Income Tax (IR) or Corporate Tax(CI).

Companies are subject to

- Taxation of its profits,

- Territorial economic contribution (CET),

- VAT.

Individual companies (craftsmen, tradesmen), the liberal professions and EURL (one-man limited liability company) must pay the IR.

Partners are taxed personally in respect of income tax only on the salaries or dividends

(National Report France, 2018).

1. Basic concepts and explanations

1.6. Registration to professional and occupational associations

For TÜRKİYE

- KOSGEB (The Small and Medium Enterprises Development Organization)

- The General Directorate of the Status of Women (KSGM)

- Turkey Business Association (İŞKUR)

- Turkey Union of Chambers and Community Exchanges( TOBB)

- Supports of Republic of Turkey Ministry and Social Policies

- Turkish Grameen Microfinance Program

- Bank loans for women

For SLOVENIA

Non-financial State Support

- VEM Points

- Business incubators

- University incubatorsTechnology parks

- Initiative start up Slovenia

- The European Enterprises Network

- SPIRIT Slovenia

Financial Supports in Slovenia

- Slovenian Enterprise Fund

- Employment Service of Slovenia

- Slovenian Regional Development Fund

- Bank Loans

Other Supports

- Chamber of Commerce &Industry

- Chamber of Craft and Small Business of Slovenia

- Business Angels of Slovenia

For POLAND

- European Union Funds for women-entrepreneurs (NGOs, Public Bodies,..etc)

- European Social Fund (PO WER-Operational Program Knowledge Education Development)

- Non-EU sources (governmental, private, etc)

- Polish Agency for Enterprise Development

- The Loan Fund for Women

- Business Angels

For GREECE

- Seed Capital (small funding for a specific population such as young people, unemployment)

- OAED Program (for the public)

- The Open Fund (for the private sector)

- Bank Loans

- Partnership Agreement (PA) 2014-2020 (ESPA)

- Greek Community Abroad

For FRANCE

- CFE

- Register of Commerce and Companies (RFS)

- ACCRE-This Device is set up to help job seekers and facilitate the creation of their businesses.

- The BPI France (Public Investment Bank)

- PRI (Regional Innovation Partnership)

- Business Angels

- Entreprendre au Feminin

1. Basic concepts and explanations

1.7. Contract formation issue for e-trade

For all countries, the main steps are described as below:

Step 1: Establishing the offer and acceptance procedure

Step 2: Completing the order form

Step 3: Incorporating the terms and conditions

Step 4: Taking the consumer's credit card details on-line

Step 5: Acknowledging receipt of the order

Step 6: Providing confirmation of the information provided and the right to cancel

Step 7: Delivery

For TÜRKİYE

The E-Commerce Regulations require that all commercial web sites make the following information directly and permanently available to consumers via the website:

the company's name, postal address (and registered office address if this is different) and email address;

the company's registration number;

any Trade or Professional Association memberships;

the company's VAT number.

All of these data must be included regardless of whether the site sells on-line. In addition, any commercial communication such as e-mail or SMS text service used in providing an "Information Society Service" must display this information.

The E-Commerce Regulations also require that all prices must be clear, and web sites must state whether the prices are inclusive of taxes and delivery costs (National Report Turkey, 2018).

For SLOVENIA

Register the company to the Public Payments Administration of the Republic of Slovenia.

Obtain access to using the portal for issuing invoices. (before a digital certificate must be obtained).

Website of the Public Payments Administration of the Republic of Slovenia can be accessed (National Report Slovenia, 2018).

For POLAND

Since 2018, each entrepreneur has to prepare VAT.

As a result, entrepreneur must prepare the invoice (preparing e-invoice is given not only by the computer programs, but also by some banks via bank accounts.)

All required documents related to social security of entrepreneur have to be seen, in electronic form via dedicated program prepared by SII (Social Insurance Institution-called PLATNIK) (National Report Poland, 2018).

For GREECE

E- invoicing was partly introduced in Greece, 2006.

But the electronic system is still not fully operating, will be completed till the end of 2019.

Aiming that, as soon as an invoice is issued, to notify in real time the client’s accounting system to accept the charge, at the same time tax office can collect the tax (National Report Greece, 2018).

For FRANCE

Commercial sides which collect personal info (name, e-mail..)and constitute files of customers and prospect, must make a simplified declaration to the National Commission for Informatics and Liberties.

Online trade sites generally fall under Simplified Standards 48 (National Report France, 2018).

1. Basic concepts and explanations

1.8. Contract formation issue for e-trade

For E-trade, the following information must be made available on the website for users:

- Information regarding:

- The commercial title, commercial address, tax or trade registry number, e-mail address, telephone number, and names of administrator(s) of the website (and, where operating an online marketplace, the official communication information of the sellers/providers);

- Whether the website is operating under the license or permission of a governmental agency, and the relevant agency.

- Terms and conditions of visiting and using the website.

- Privacy policy.

- Electronic signature is mandatory.

- User agreement (if membership is required).

- Distance contract to be prepared according to the Regulation for Distance Contracts (if the website will sell any goods or services to consumers) under Consumer Protection Law No. 6502.

- To co-ordinate the money flow between the consumers and the online business enterprise, the online business must collaborate with a bank or a payment service provider (Payment Services Law No. 6493) (Dora et al. 2018).

2. Active learning

TAX Obligations

Follow the directions to fulfill tax obligations:

Registration of business brand name

Follow the directions to register business brand name:

Application to local licences and permits

Follow the directions to apply for licenses and permits:

Getting tax identification number

Follow the directions to get tax identification number:

Registration to proffesional and occupational associations

Follow the directions to registration for professional and occupational associations:

4. References

Anonymous, 2018a. 22.09.2018.Trademark vs. Brand: Everything You Need to Know.

https://www.upcounsel.com/trademark-vs-brand

Anonymous, 2018b. 22.09.2018.

https://www.smallbusiness.wa.gov.au/business-advice/starting-your-business/business-names

Anonymous, 2018c. 22.09.2018.

https://www.slideshare.net/TahminaSharmin/mc-donalds-strategic-management-analysis

Anonymous, 2018d. 14.08.2018. Business name, trading names & legal names.

https://www.business.gov.au/registrations/register-a-business-name/business-name-trading-names-legal-names

Anonymous, 2018e. 22.09.2018. What is Brand Registration?

http://www.uktrademarkregistration.co.uk/brand-registration/What-is-Brand-Registration.aspx

Anonymous, 2018f. 22.09.2018.

https://en.wikipedia.org/wiki/Taxpayer_Identification_Number

Cameron, A. 2017. Business Name vs. Trading Name, Do You Know the Difference?.

https://www.patriotsoftware.com/accounting/training/blog/business-name-or-trade-name-difference/

Dora, E.K., Ozer, C. and Korkmaz, T. 2018. Digital business in Turkey: overview.

https://uk.practicallaw.thomsonreuters.com/5-618-1186?transitionType=Default&contextData=(sc.Default)&firstPage=true&bhcp=1

Fishman, S. 2015. What’s in a Name? Choosing and Protecting Your Business Name.

https://www.mileiq.com/blog/whats-in-a-name-choosing-and-protecting-your-business-name/

Forbes Agency Council. 2017. 24.10.2017.

https://www.forbes.com/sites/forbesagencycouncil/2017/10/24/18-steps-to-take-before-you-launch-a-product-or-service/#5772b0bf19cf

Hubsey, A. 2016. Unit 9-Commercial Aspects of Engineering Organizations.

https://www.coursehero.com/file/14108141/Unit-9-Commercial-Aspects-of-Engineering-Organizations/

National Report Turkey 2018. National Report created by Gazi University Partner in Dreamy M-Learning Project.

National Report Slovenia 2018. National Report created by Ljubljana University Partner in Dreamy M-Learning Project.

National Report Poland 2018. National Report created by Danmar Computers Partner in Dreamy M-Learning Project.

National Report Greece 2018. National Report created by IDEC Partner in Dreamy M-Learning Project.

National Report France 2018. National Report created by GUIMEL Partner in Dreamy M-Learning Project.

Shravani, P.T. 2017. Understanding the Difference Between Company Name and Trademark.

http://www.iamwire.com/2017/08/difference-company-name-trademark/156468

Shim, J.K. 2009. The Pocket MBA: Concepts and Strategies. Delta Publishing Company, Los Alamitos, California.